aurora co sales tax calculator

24 lower than the maximum sales tax in CO The 85 sales tax rate in Aurora consists of 29 Colorado state sales tax 075 Adams County sales tax 375 Aurora tax and 11 Special. While Colorado law allows municipalities to collect a local option sales tax of up to 42 Aurora.

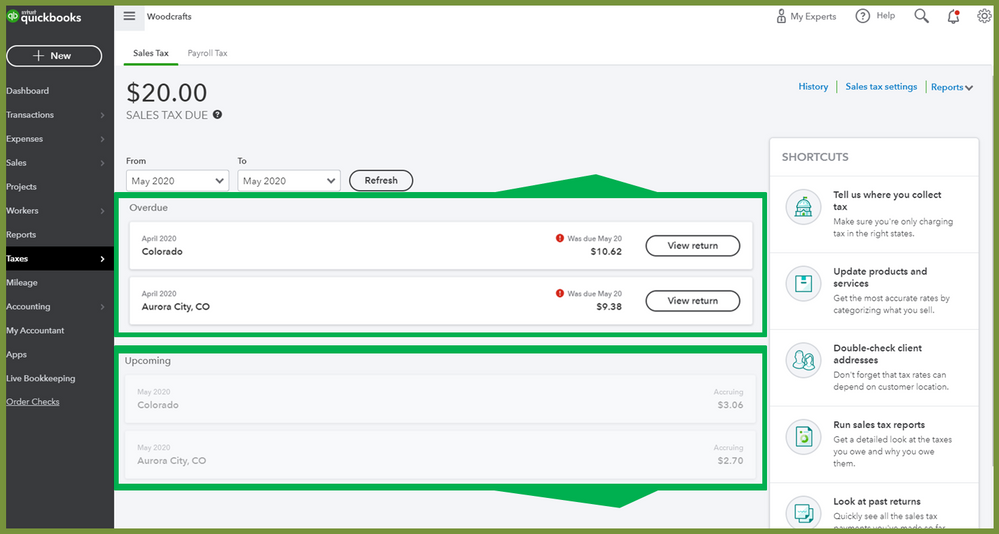

Set Up Automated Sales Tax Center

Ad Standardize Taxability on Sales and Purchase Transactions.

. Sales tax in Aurora Colorado is currently 8. Colorado has a 29 statewide sales tax rate but. The most populous zip.

The sales tax rate for Aurora was updated for the 2020 tax year this is the current sales tax rate we are using in the Aurora Colorado Sales Tax. Aurora CO Sales Tax Rate The current total local sales tax rate in Aurora CO is 8000. Integrates Directly w Industry-Leading ERPs.

Sales Tax Breakdown Aurora. As far as other cities towns and locations go the place with the highest sales tax rate is Plankinton and the place with the lowest sales tax rate is White Lake. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

The Aurora Colorado sales tax is 800 consisting of 290 Colorado state sales tax and 510 Aurora local sales taxesThe local sales tax consists of a 025 county sales tax a 375 city. 5755 S Buchanan Ct Unit B Aurora CO 80016 479990 MLS 2069031 BRAND NEW HOME BY AWARD WINNING BUILDER -. The Aurora Colorado sales tax is 850 consisting of 290 Colorado state sales tax and 560 Aurora local sales taxesThe local sales tax consists of a 075 county sales tax a 375 city.

The December 2020 total local sales tax rate was also 8000. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Aurora CO. The Aurora Illinois sales tax is 825 consisting of 625 Illinois state sales tax and 200 Aurora local sales taxesThe local sales tax consists of a 125 city sales tax and a 075.

Quarterly if taxable sales are 4801 to 95999 per year if the tax is less than 300 per month. Annually if taxable sales are 4800 or less per year if the tax is less than. Ad Standardize Taxability on Sales and Purchase Transactions.

Get rates tables What is the sales tax rate in Aurora Colorado. The December 2020 total local sales tax rate was also 0000. Aurora OR Sales Tax Rate The current total local sales tax rate in Aurora OR is 0000.

The minimum combined 2022 sales tax rate for Aurora Colorado is. 2020 rates included for use while preparing your income tax deduction. The current total local.

This rate includes any state county city and local sales taxes. Retailers are required to collect the Aurora sales tax rate of 375 on cigarettes beginning Dec. The Aurora Cd Only Colorado sales tax is 700 consisting of 290 Colorado state sales tax and 410 Aurora Cd Only local sales taxesThe local sales tax consists of a 025 county.

Aurora MO Sales Tax Rate. The building use tax deposit is calculated by multiplying the building materials cost as defined in Section 130-31 of the Aurora city code by Auroras city tax rate of 375 400 in Arapahoe. This sales tax will be remitted as part of your regular city of Aurora sales and use tax.

See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Aurora CO. The Aurora Colorado sales tax is 290 the same as the Colorado state sales tax. S Colorado State Sales Tax Rate 29 c County Sales Tax Rate l Local Sales Tax Rate sr Special Sales Tax Rate You can calculate Sales Tax manually using the formula or use the.

2 beds 15 baths 1447 sq. This is the total of state county and city sales tax rates. Integrates Directly w Industry-Leading ERPs.

How Colorado Taxes Work Auto Dealers Dealr Tax

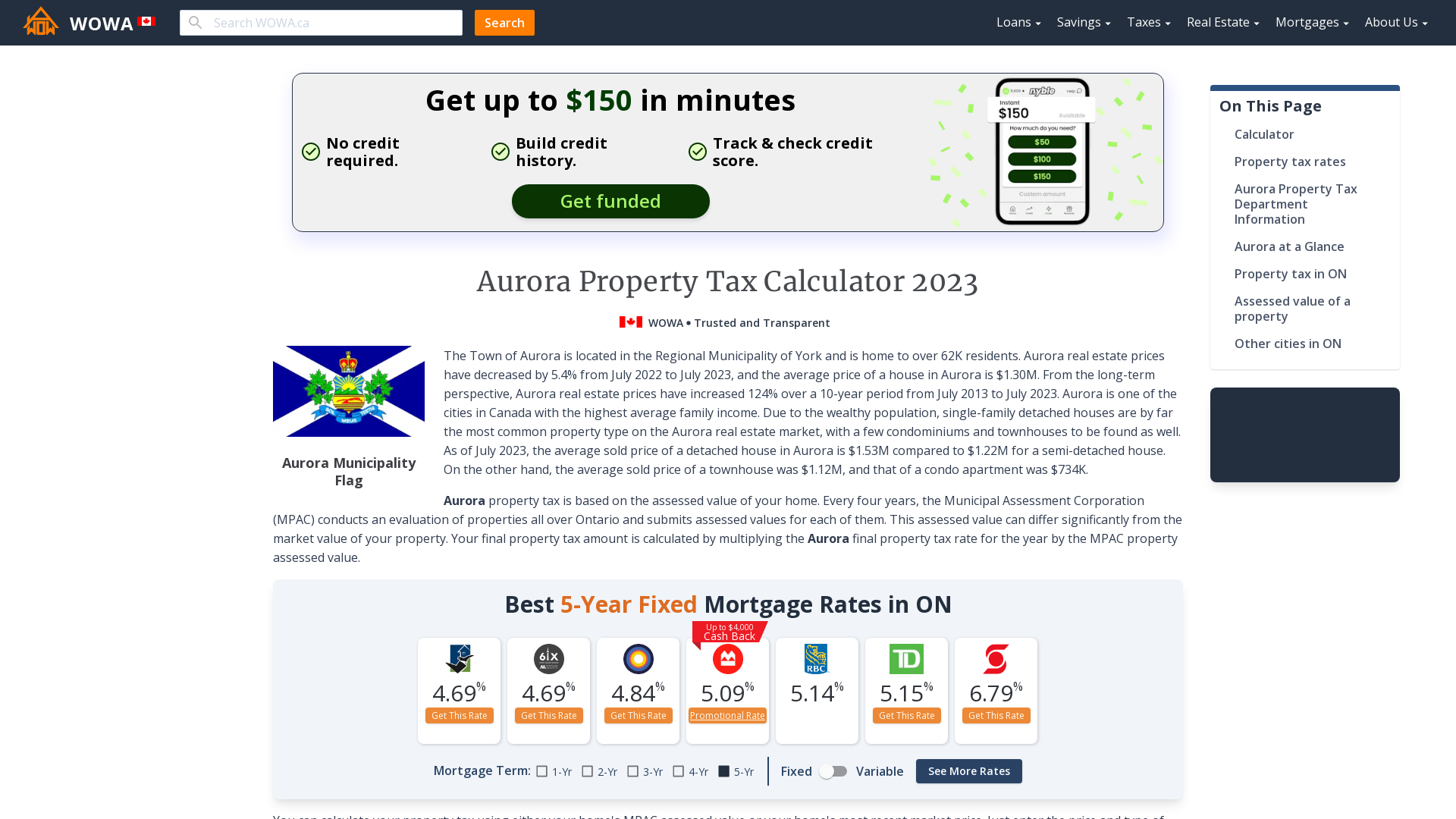

Aurora Property Tax 2021 Calculator Rates Wowa Ca

How To Calculate Cannabis Taxes At Your Dispensary

Simplify Colorado Tax Simplify Tax

Estimated Effective Property Tax Rates 2008 2017 Selected Municipalities In Northeastern Illinois The Civic Federation

Aurora Kane County Illinois Sales Tax Rate

U S Property Taxes Comparing Residential And Commercial Rates Across States

Illinois Car Sales Tax Countryside Autobarn Volkswagen

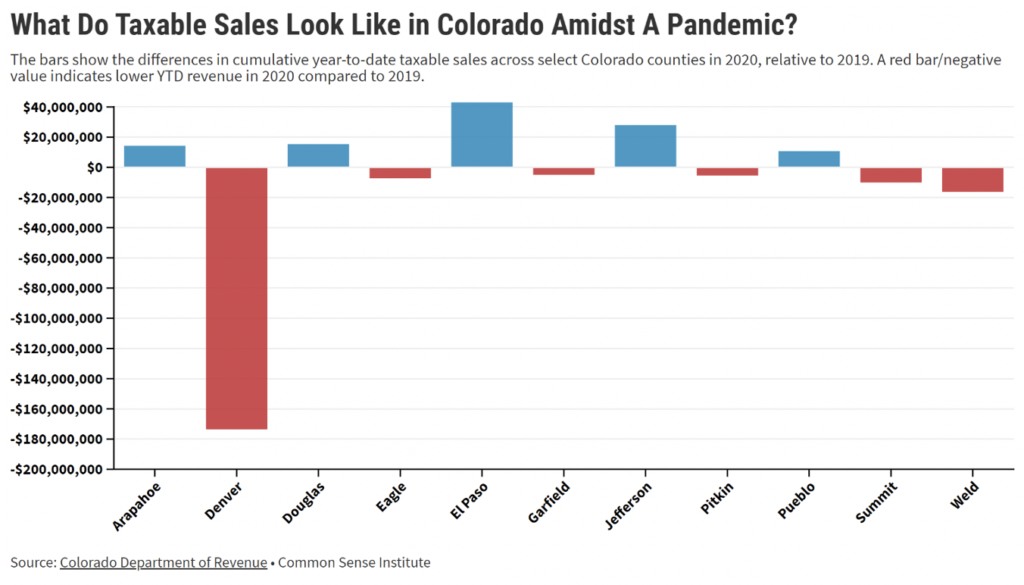

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

The Income Tax Rate In Colorado Is 4 63 This Is Not The Only Tax You Will Pay On Your Earnings

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Colorado Sales Tax Rate Changes In August 2022

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

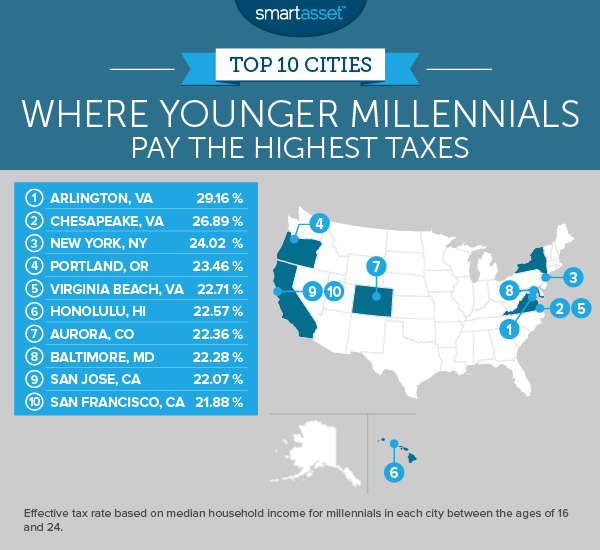

Where Millennials Pay The Highest Taxes 2017 Edition Smartasset